In the rapidly evolving world of financial technology, two powerful concepts are reshaping how institutions innovate and compete: open innovation and open banking. While closely related, these forces represent distinct approaches with far-reaching implications. Understanding their differences is crucial for any organisation looking to stay ahead of the curve.

In this article, we dive into these concepts and how businesses can leverage them in driving their innovation strategy.

The Open Innovation Paradigm

Open innovation refers to the collaboration and exchange of ideas between internal and external stakeholders. Think of it as a mass idea bank that is open to, and contributed by, all.

Open innovation is a novel concept as it goes against the traditional framework of closed innovation that typically involves financial institutions operating in silos.

By increasing the pool of collective knowledge, financial institutions can accelerate their innovation and drive sustainable growth. A key example of this is open innovation challenges that are quickly gaining prominence amongst leading organisations.

The Promise of Open Banking

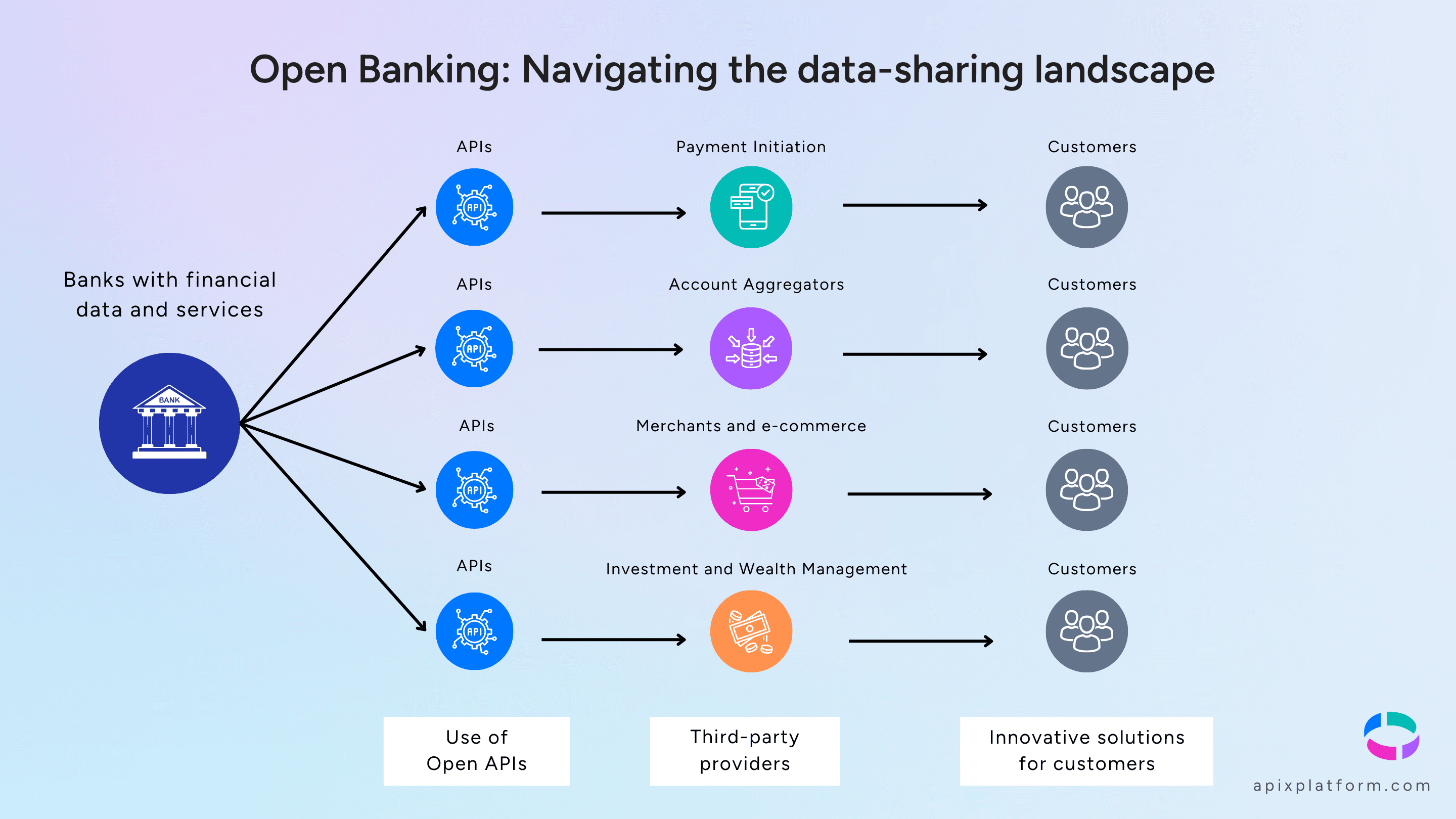

Open banking is a focused application of the broader open innovation concept. The key distinction lies in open banking’s specific scope: the sharing of financial data and services with third-party providers through Application Programming Interfaces (APIs).

This facilitates collaboration between financial institutions and FinTechs that result in innovative solutions for customers. Regulatory frameworks such as the Payment Services Directive (PSD2) in Europe and Financial Planning Digital Services (FPDS) in Singapore guide the adoption of this concept by mandating data access and promoting innovation within the sector.

Differences between open innovation and open banking

While conceptually similar, open innovation and open banking do differ in their specific focus and applications:

| Open Innovation | Open Banking |

|---|---|

| Fosters inter-industry collaboration | Focuses on the finance sector |

| Broad ideation and crowdsourced R&D | Involves data sharing and API integration |

| Emphasises operational agility and new business models | Enhances customer offerings and user experience |

Types of use cases

Open innovation and open banking have catalysed powerful transformations across fintech, including:

Digital banks redefining consumer finance

Open banking and open innovation have paved the way for more banking services that enhance the overall customer experience. Take digital banks for example.

Just a decade ago, consumers were largely confined to the offerings of major traditional banks. However, today's landscape boasts a proliferation of digital banks, such as Trust Bank, GXS, and the recent entry of Maribank in 2023, each offering a diverse array of consumer benefits. These digital banks are heralding a transformative era in digital FinTech services.

Streamlined customer onboarding and KYC

Another key benefit has been the simplification of the typically cumbersome onboarding processes. Traditionally, opening a new bank account or applying for financial products involved manual, time-intensive procedures.

With open banking APIs and digital identity verification, financial institutions can now streamline customer acquisition and Know Your Customer (KYC) compliance - making onboarding more seamless, secure, and convenient. This innovation dramatically improves customer acquisition capabilities.

“Connected finance” unifying fragmented ecosystems

Most organisations rely on a fragmented toolset, with data and workflows operating in silos requiring manual coordination across functions. Connected finance, enabled by open banking APIs, unifies these interconnected processes into cohesive, simplified workflows.

This unified approach provides CIOs with greater visibility, enhances cross-functional collaboration, and unlocks dynamic, data-driven decision-making to boost organisational efficiency.

Leveraging Open Innovation and Open Banking for success

More often than not, financial institutions will find significant overlap between the drivers of open innovation and open banking. In fact, it is their powerful combination that creates fertile ground for generating new business models, products, and services to exponentially multiply the possibilities of the fintech industry.

Open banking enables open innovation in the financial services sector by providing the necessary data pipelines and technical infrastructure. This leads to enhancements in fintech capabilities, greater collaborative opportunities, and customer-centric innovations. It is a virtuous cycle where each concept propels the other forward.

To capitalise on these opportunities, financial institutions must adopt a holistic approach to innovation coupled with cultural transformation.

This involves fostering an organisational culture of collaboration, experimentation, and agility that empowers employees to embrace change and drive innovation from within.

Your innovation flight path with APIX

Undergoing this cultural transformation requires expert guidance. APIX is a global innovation platform purpose-built to help financial institutions succeed.

With APIX’s expertise, you can run innovation challenges in days (not months), reducing R&D timelines. Sandboxes and digital testing environments accelerate product deployment by up to 75%.

The future belongs to the innovators. Is your organisation ready to take flight?

Book a call with our team to start building a strategy combining the power of both open innovation and open banking!